Insurance is one of those things most people live with for years before they really understand it. Policies get bought during big life moments buying a car, starting a job, purchasing a home, having children. At first, it feels like a box to tick. Over time, it becomes something far more real. Everything you need to know about Insurance begins with understanding that insurance exists to deal with uncertainty, not eliminate it. Life doesn’t wait for financial readiness, and insurance tries to bridge that gap.

At its core, insurance is about shared responsibility. You pay a predictable amount so that unpredictable losses don’t destroy your finances. Different insurance coverages exist because risks don’t look the same for everyone. A renter faces different dangers than a homeowner. A traveler faces different risks than a business owner. Insurance adapts itself to those realities, but only if the policyholder understands what they’re actually buying.

Everything you need to know about Insurance like Definition, how it works, and its types

Insurance can be defined as a formal agreement where one party agrees to compensate another for specific losses in exchange for regular payments. That definition sounds simple, but the real mechanics are layered. Insurance works because large numbers of people contribute small amounts into a shared pool. Losses are expected, just not for everyone at the same time.

The types of insurance developed over time as societies changed. When people owned little, insurance focused on health and survival. As assets grew, insurance expanded to property, vehicles, businesses, and liability. Modern insurance reflects modern life. It protects not only physical things but also income, legal responsibility, and future plans.

What is insurance?

Insurance is a financial contract designed to soften the impact of loss. It does not prevent accidents, illness, or damage. Instead, it ensures that when something goes wrong, recovery is possible. Without insurance, many events would push people into debt that takes years to escape.

Insurance policies clearly define what qualifies as a covered event. This clarity protects both sides. Policyholders know what they can expect, and insurers know what they are responsible for. The challenge is that people often skim these details until a claim is denied. Understanding insurance before that moment changes the entire experience.

Key Takeaways

Insurance shifts financial risk away from individuals and spreads it across many policyholders. Premiums are paid regularly to keep coverage active. Claims are only paid when policy conditions are met. Limits, deductibles, and exclusions shape how useful a policy truly is. Insurance rewards preparation, not reaction.

Investopedia Answers

From an economic perspective, insurance relies on statistical prediction. Insurers study loss patterns across industries and populations. They price insurance policies so that total premiums exceed expected claims. This structure allows insurers to remain stable while paying out losses when they occur.

How does insurance work?

Insurance works through agreement and verification. When a policyholder buys coverage, they agree to the terms laid out in the insurance policy. When a loss occurs, the insurer verifies whether the event fits within those terms. This verification process is what makes insurance both reliable and frustrating.

Claims don’t get approved simply because something bad happened. They are approved because the event matches policy language. Questions like whether house insurance cover fences come down to cause, maintenance, and exclusions. Insurance is less about fairness and more about definitions.

What is an insurance premium and how is it calculated?

Insurance premiums represent the cost of transferring risk. Insurers calculate premiums by analyzing personal data, asset value, location, history, and behavior. Two people buying identical coverage may pay very different prices.

Higher premiums usually reflect higher likelihood of claims. Lower premiums often come with higher deductibles or limited coverage. Premiums are not punishment; they are pricing models based on probability.

What is a policy term?

A policy term defines how long coverage lasts. Most insurance policies operate on annual terms, but some run shorter or longer. Coverage only applies during this period. Missed payments or non-renewal end protection immediately.

Understanding the policy term matters because claims must occur while coverage is active. Timing mistakes lead to denied claims more often than people realise.

How does a policy limit work?

Well, if you search Everything you need to know about Insurance, you will see that some people describe insurance in detailed majorly, they cover only in health insurance but here in this article you will get to know everything related to insurance because our main goal is to give you detailed insights about insurance. Well, when we discussed policy limit then, i will tell you that Policy limits cap how much the insurer will pay. Once the limit is reached, all remaining costs fall on the policyholder. Limits exist to keep insurance affordable and predictable for insurers. Low limits may save money upfront but expose policyholders to major losses later. High limits cost more but provide peace of mind.

What is a deductible and how does it work?

A deductible is the portion of a loss paid by the policyholder before insurance contributes. Deductibles reduce small claims and lower premiums. They force policyholders to share responsibility. Choosing a deductible is a balance between monthly affordability and emergency readiness.

What are the most common types of insurance?

Insurance touches nearly every part of daily life.

Auto insurance

Auto insurance protects drivers from liability, property damage, and injury-related expenses. Laws often require minimum coverage, but those minimums rarely cover serious accidents. Comparing auto insurance vs home insurance highlights how liability risk differs across assets.

Home insurance

Home insurance protects structures, belongings, and personal liability. Coverage depends heavily on cause of loss. Fire, storms, and theft are common covered risks. Floods and earthquakes often require separate policies.

Health insurance

Health insurance manages medical costs that would otherwise be unmanageable. It works through provider networks, cost-sharing, and coverage tiers. Understanding deductibles and out-of-pocket limits is essential for real protection.

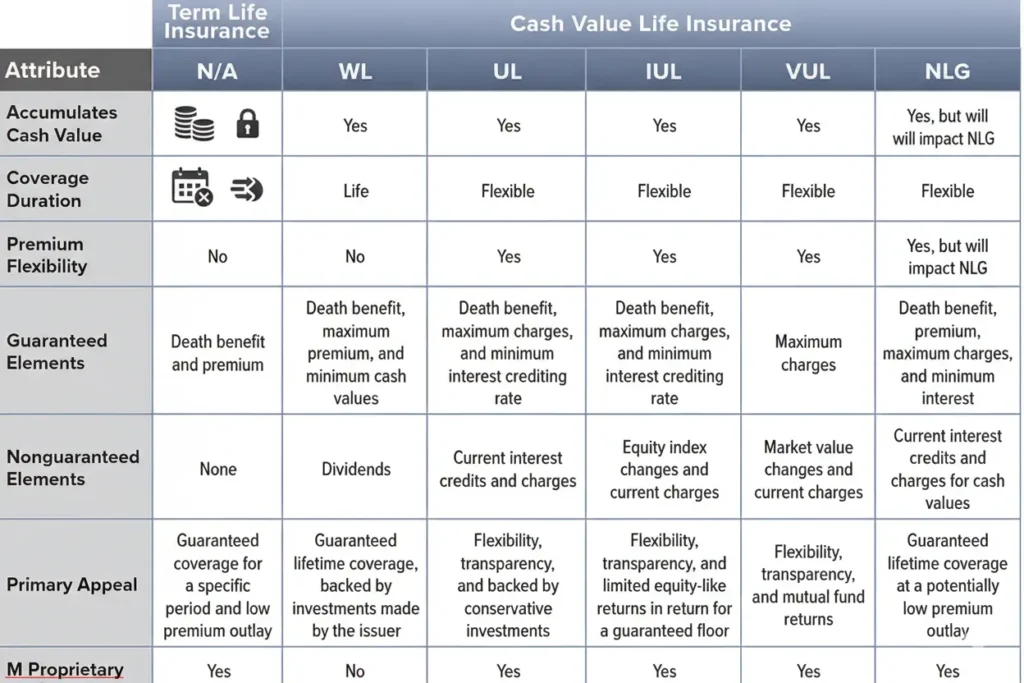

Life insurance

Life insurance supports dependent after death. It replaces income, covers debts, and funds future needs. Life insurance planning depends on age, health, and financial goals. so, you must understand the health benefits of insurance.

Business Insurance

Business insurance shields companies from lawsuits, property damage, and operational disruptions. Without it, a single claim can end a business permanently.

Study Insurance

Study insurance protects students during education, especially abroad. It covers health emergencies, accidents, and travel-related risks.

Common Insurance Terms Defined

Insurance language is meant to be precise, but precision doesn’t always translate into clarity. Many of the most common terms sound simple on the surface, yet they quietly shape how much you pay, when you pay, and how much help you actually receive when something goes wrong. People often assume these words matter only when filing a claim. In reality, they affect everyday decisions whether to visit a doctor, choose a provider, or submit a bill. Understanding these terms ahead of time prevents surprises that usually show up when stress is already high.

Co-insurance

Co-insurance comes into play after your deductible has been met, and this is where many people misunderstand how shared costs really work. Once the deductible is paid, co-insurance determines how remaining expenses are divided between you and the insurance provider. A common setup might be 80/20, where the insurer pays 80 percent of covered costs and you handle the remaining 20 percent.

That percentage may sound manageable until medical bills start adding up. A 20 percent share on a large hospital bill can still mean thousands out of pocket. Co-insurance exists to keep policyholders engaged in cost decisions. When insurance pays everything, people tend to use services more freely. When there’s shared responsibility, people pause, ask questions, and compare options.

Co-insurance also varies by service. Some plans apply different rates for specialist visits, hospital stays, or out-of-network care. It’s not unusual for someone to think they understand their plan, only to realize later that one type of care carries a much higher co-insurance share. This is why reading the breakdown matters just as much as knowing the deductible amount.

Coordination of Benefits

Coordination of benefits becomes relevant when someone is covered by more than one insurance policy. This often happens through a spouse’s plan, a parent’s plan, or a combination of employer coverage and government programs. Without coordination rules, claims would turn into disputes over who pays what.

This process decides which insurance plan acts as the primary payer and which one becomes secondary. The primary plan pays first according to its rules. The secondary plan may then cover some or all of what remains, depending on its own coverage limits. The goal is not to allow double payment, but to prevent gaps in coverage.

In real life, coordination of benefits can feel slow and paperwork-heavy. Claims may bounce back and forth if information is missing or outdated. Still, when it works correctly, it can significantly reduce out-of-pocket costs. The key is accuracy. Even small errors, wrong employer details, outdated policy numbers can delay payments or cause denials that take months to fix.

Co-payment

A co-payment, often called a copay, is the fixed amount you pay at the time of receiving a service. It doesn’t change based on the total bill and usually applies to routine care such as doctor visits, prescriptions, or urgent care. Whether the visit costs $80 or $300, the copayment stays the same.

Copayments are designed to be predictable. They give policyholders a clear idea of what a visit will cost before walking through the door. This predictability helps people budget for care and avoid skipping necessary appointments due to uncertainty.

That said, copayments don’t exist in isolation. They often interact with deductibles and co-insurance in ways that aren’t obvious. Some plans require deductibles to be met before copays apply. Others waive deductibles for primary care but not for specialists. Over time, frequent copayments can quietly add up, especially for people managing chronic conditions.

Understanding how copayments fit into the larger structure of a policy changes how you use insurance. Instead of being surprised by bills weeks later, you know upfront which costs are fixed and which ones might grow.

Covered Expenses

Covered expenses define what insurance actually pays for.

| Term | Explanation |

| Customary Fee | Standard service charge |

| Deductible | Initial cost paid |

| Exclusions | Non-covered risks |

| Explanation of Benefits | Claim breakdown |

| HMO | Restricted network |

| Managed Care | Cost control model |

| Maximum Out-of-Pocket | Spending cap |

| Non-cancellable Policy | Guaranteed coverage |

| PPO | Flexible access |

| Pre-existing Condition | Prior diagnosis |

| Premium | Coverage cost |

| Primary Care Physician | Care coordinator |

| Provider | Service source |

| Third-party Payer | Claim payer |

What are the benefits of taking out insurance?

Insurance benefits extend beyond financial reimbursement. Insurance allows people to plan long-term without constant fear of financial collapse. It encourages entrepreneurship, travel, and investment.

Insurance creates stability not by eliminating risk, but by making risk survivable.

What is the main purpose of insurance?

The main purpose of insurance is protection against financial ruin. It exists so one mistake, accident, or illness does not define the rest of a person’s life.

What are the 5 benefits of insurance?

Insurance is often treated as a legal requirement or a monthly bill, but its real value shows up during moments people rarely plan for. The benefits go beyond money. They influence decision-making, stability, and even peace of mind over long periods of time.

Risk reduction

At its core, insurance works by spreading risk across a large group of people. Instead of one person carrying the full financial weight of a loss, that burden is shared. When many individuals contribute small amounts through premiums, the insurer is able to pay for the few who experience damage or loss at any given time.

This doesn’t eliminate risk, but it reshapes it into something manageable. Large, unpredictable expenses become smaller, predictable ones. For individuals, this means a single accident or illness is less likely to cause long-term financial damage. For businesses, it means risks that could shut doors permanently are absorbed and redistributed, allowing recovery instead of collapse.

Financial stability

Unexpected expenses can destabilize even well-planned finances. Medical emergencies, property damage, or legal claims often come with costs that exceed savings. Insurance acts as a buffer between these events and your financial life.

By covering a significant portion of losses, insurance prevents sudden shocks that might otherwise lead to debt, asset liquidation, or long-term financial strain. Instead of draining savings or taking high-interest loans, policyholders rely on pre-arranged coverage. Over time, this stability allows households and organizations to plan with confidence, knowing that a single incident is unlikely to undo years of progress.

Business continuity

For businesses, insurance is closely tied to survival. Fires, lawsuits, data breaches, and natural disasters don’t just damage property, they interrupt operations. Without protection, even a temporary shutdown can lead to lost customers, unpaid employees, and broken contracts.

Insurance helps businesses stay operational or recover quickly after a loss. Coverage for property damage, liability claims, and business interruption provides the financial breathing room needed to rebuild, relocate, or continue paying essential expenses. This continuity protects not only the business owner, but also employees, suppliers, and customers who depend on the company’s stability.

Lessen psychological stress

Financial uncertainty carries emotional weight. Knowing that a single event could erase savings or create unmanageable debt adds constant pressure. Insurance reduces this mental burden by replacing uncertainty with structure.

When coverage is in place, people worry less about “what if” scenarios. That doesn’t mean stress disappears entirely, but the presence of a safety net changes how people respond to risk. Decisions feel less overwhelming when there is a clear path forward after a loss. Over time, this sense of security contributes to better mental well-being and more confident long-term planning.

Asset protection

Assets gain value over time, but they are also exposed to loss, damage, and depreciation. Insurance helps preserve that value by ensuring that damage does not permanently erase years of investment.

Homes, vehicles, equipment, and even income streams are protected through policies designed to restore or replace them after covered events. Without insurance, asset loss often forces people to sell other valuables or delay rebuilding. With insurance, recovery becomes a structured process rather than a financial scramble. This protection allows assets to serve their intended purpose building stability and long-term value rather than becoming liabilities during crises.

What risks are not covered by insurance?

Insurance coverage is intentional, not unlimited. Policies are designed to protect against sudden, accidental, and unforeseen events—not every possible loss. Exclusions exist to prevent misuse and to keep premiums affordable for everyone.

Intentional acts are almost always excluded. Damage caused on purpose, whether to property or people, falls outside the scope of coverage. Illegal activities are also excluded, as insurance is not meant to shield individuals from the consequences of unlawful behavior.

Neglect is another common exclusion. When damage occurs due to failure to maintain property or follow basic safety standards, insurers typically deny claims. Insurance responds to accidents, not ongoing deterioration. Normal wear and tear, aging materials, and gradual breakdowns are considered part of ownership, not insurable events.

This distinction matters. Insurance is a risk-transfer tool, not a maintenance plan or a guarantee against all loss. Understanding exclusions helps set realistic expectations and encourages responsible behaviour, which ultimately keeps insurance systems sustainable for everyone.

Who bears risk in insurance?

Risk is shared among policyholders, insurers, and reinsurers. No single entity absorbs all losses. This balance keeps insurance functional.

Conclusion

Understanding everything you need to know about insurance takes time, not expertise. Insurance basics for beginners start with knowing how insurance policies work and why exclusions exist. Whether someone is asking can i cancel pet insurance before surgery, reviewing travel options like expedia travel insurance, or wondering do we need to insure a travel trailer, the real answers always live inside the policy terms. Insurance isn’t flawless, but when chosen carefully, it remains one of the most reliable tools for managing uncertainty in everyday life.