When people start planning a trip, the excitement usually comes first tickets, hotels, itineraries. Insurance tends to be an afterthought, even though it quietly carries most of the financial risk. If you’ve ever compared different travel insurance plans, you’ve probably noticed how complicated the wording can be. Understanding what Does travel insurance cover is less about memorizing policy language and more about recognizing the risks tied to travel itself.

That’s why many travelers stop and ask what exactly they are paying for. In simple terms, a policy works much like other insurance coverages. It steps in when something unexpected disrupts your plans or threatens your health or belongings.

What Does Travel Insurance Cover? Understanding the Core Protections

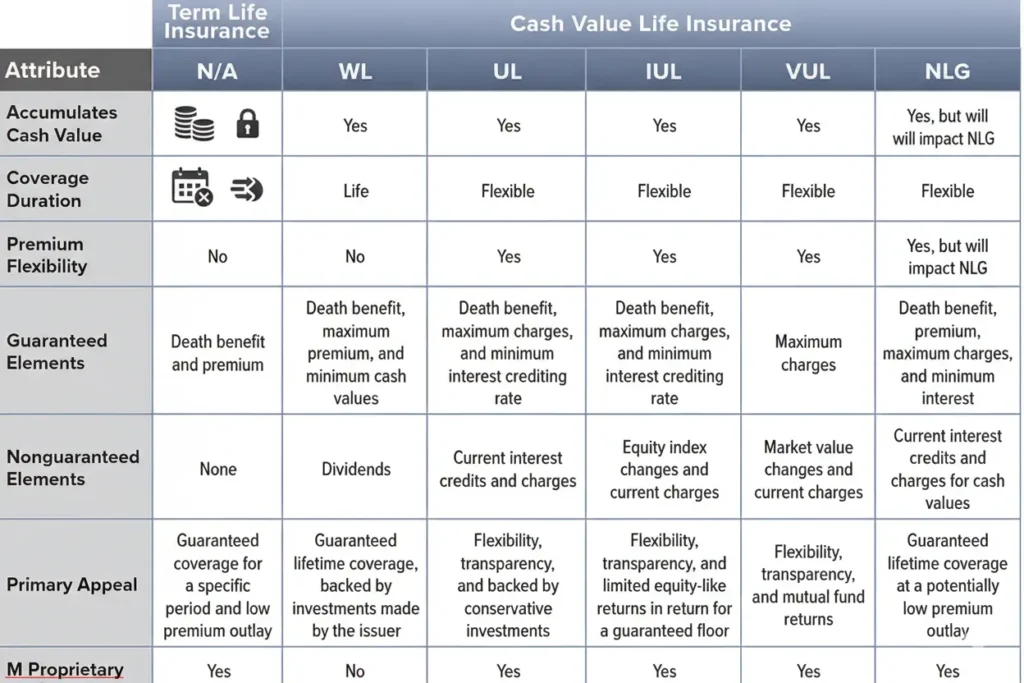

Before buying any plan, it helps to pause and think carefully about what should travel insurance cover for your specific trip. Not every traveler needs the same protection. A weekend road trip is different from a month-long international tour. Still, most travel insurance coverage revolves around a few central pillars: medical protection, trip-related reimbursements, and personal property safeguards.

At its foundation, a standard travel insurance policy typically includes trip cancellation, trip interruption, emergency medical expenses, and sometimes lost baggage coverage. Some plans also provide travel delay reimbursement, emergency evacuation services, and accidental death benefits. When people ask what does travel insurance cover, these are usually the first categories insurers point to.

The key is not just that coverage exists, but how much of it exists. Limits vary widely. One plan might offer $50,000 for medical coverage abroad, while another provides $500,000. That difference matters if you’re hospitalized in a country with expensive healthcare systems.

Trip Cancellation: Protecting Your Investment Before You Leave

Trip cancellation is often the most talked-about travel insurance benefit. It reimburses you for prepaid, non-refundable expenses if you have to cancel before departure due to a covered reason. Covered reasons typically include serious illness, injury, death of a family member, or sometimes severe weather events.

Imagine booking international flights, hotels, and tours months in advance. If you suddenly fall ill, you could lose thousands of dollars. A solid travel insurance policy with trip cancellation can reimburse those costs.

Still, this is where policy exclusions become important. Not every reason qualifies. Changing your mind or finding a better deal elsewhere usually won’t count. Some insurers offer “Cancel For Any Reason” add-ons, but they tend to reimburse only a portion of your total expenses. When evaluating what should travel insurance cover, trip cancellation protection often ranks near the top because it directly protects your upfront investment.

Trip Interruption: When Plans Change Mid-Journey

Trip interruption coverage applies once your trip has already begun. If something forces you to cut it short like a family emergency or sudden illness, it can reimburse unused portions of your trip and sometimes cover additional transportation costs to return home.

This aspect of travel insurance coverage is often overlooked until something goes wrong. For example, you might need to return home unexpectedly after only three days of a ten-day vacation. Without trip interruption protection, you could lose the remaining hotel nights and prepaid excursions.

In some cases, policies also reimburse extra accommodation if you’re delayed. People often compare this to how a homeowner might wonder whether house insurance cover fences in certain situations; it’s about understanding the scope and limits of what’s actually protected. With travel insurance, reading those limits carefully makes all the difference.

Medical Coverage Abroad: The Most Critical Component

For international travelers, medical coverage abroad is arguably the most important element of travel insurance. Many domestic health insurance plans offer little or no coverage outside your home country. That means emergency medical expenses could come directly out of pocket.

Medical emergencies abroad can be expensive. A simple hospital visit may cost hundreds or thousands of dollars. A serious injury requiring surgery or evacuation can escalate quickly. This is why understanding what does travel insurance cover medically is essential.

Typical medical coverage includes:

| Coverage Type | What It Usually Covers |

|---|---|

| Emergency Medical Expenses | Hospital stays, doctor visits, medications |

| Emergency Medical Evacuation | Transport to nearest adequate medical facility |

| Repatriation of Remains | Return of remains to home country |

| Dental Emergency | Treatment for sudden dental pain or injury |

Emergency evacuation alone can cost tens of thousands of dollars. A strong travel insurance policy ensures those extreme costs don’t become a lifelong financial burden.

Emergency Medical Expenses and Pre-Existing Conditions

Emergency medical expenses are at the heart of most travel insurance benefits. Still, pre-existing conditions complicate things. Some insurers exclude them outright. Others provide limited coverage if certain conditions are met, such as purchasing the policy shortly after booking your trip.

When considering what Does travel insurance cover, it’s wise to check how the plan defines and treats pre-existing conditions. The wording matters. Waiting periods, disclosure requirements, and documentation rules can influence your ability to file a successful travel insurance claim.

Comparing this to other forms of coverage like wondering can i cancel pet insurance before surgery shows how timing and policy rules affect outcomes. With travel insurance, buying coverage early often expands your protection options.

Lost Baggage Coverage and Personal Belongings

Lost baggage coverage is another common feature. Airlines misplace luggage more often than most people expect. While airlines provide limited compensation, it may not fully replace high-value items.

Lost baggage coverage typically reimburses you for clothing, toiletries, and essential items if your luggage is delayed or permanently lost. There are usually per-item limits and total maximums.

Here’s a simplified breakdown:

| Scenario | Typical Reimbursement |

|---|---|

| Delayed baggage (12–24 hrs) | Essential purchases up to a daily limit |

| Permanently lost baggage | Replacement value up to policy maximum |

| High-value electronics | Often limited or excluded |

While this part of travel insurance coverage may not seem as urgent as medical protection, it can ease stress during already difficult travel disruptions.

Travel Delays and Missed Connections

Travel delay coverage reimburses expenses when flights are significantly delayed due to covered reasons. This may include hotel stays, meals, and local transportation. If you miss a connecting flight because of airline delays, some plans step in.

Missed connection benefits can be especially helpful during international travel. If your connecting cruise departure is missed due to a flight delay, certain policies reimburse additional transport to catch up.

Looking at specific provider examples, such as expedia travel insurance, can give travelers insight into how various companies structure delay and interruption benefits. While the structure differs, the concept remains similar across most plans.

Policy Exclusions: What Travel Insurance Does Not Cover

It’s tempting to assume that travel insurance covers every possible mishap. That isn’t the case. Policy exclusions are deliberate and often clearly stated. Common exclusions include:

- Intentional self-inflicted injuries

- Participation in high-risk activities (unless added coverage is purchased)

- Traveling against medical advice

- Losses due to intoxication

- Civil unrest or known events before policy purchase

Understanding policy exclusions is just as important as reviewing travel insurance benefits. A strong travel insurance policy outlines what’s covered and what’s not in equal detail.

Filing a Travel Insurance Claim

When something goes wrong, filing a travel insurance claim requires documentation. Receipts, medical records, police reports for theft, and airline confirmation letters are commonly required.

The claim process generally involves:

- Notifying the insurer promptly

- Submitting required documents

- Waiting for review and approval

Processing times vary. Some claims are resolved in weeks, while others take longer if documentation is incomplete. A denied claim often results from missing paperwork or a reason that falls outside covered events.

Travelers sometimes ask, do we need to insure a travel trailer before road trips in the same way they question the need for trip coverage. The answer depends on risk tolerance and financial exposure. With travel insurance, the claim process becomes smoother when you understand requirements before departure.

Comparing Travel Insurance Policies Side by Side

Because not all plans are identical, comparing key categories helps clarify what Does travel insurance cover for your needs.

| Feature | Basic Plan | Mid-Tier Plan | Comprehensive Plan |

|---|---|---|---|

| Trip Cancellation | Included | Included | Included + CFAR Option |

| Emergency Medical Expenses | $50,000 | $100,000 | $250,000+ |

| Emergency Evacuation | $100,000 | $250,000 | $500,000+ |

| Lost Baggage Coverage | Limited | Moderate | Higher limits |

| Travel Delay | Minimal | Moderate | Extensive |

The best travel insurance coverage depends on destination, trip cost, and personal health considerations.

How Much Coverage Is Enough?

There’s no universal number. A short domestic trip may require modest coverage. International trips, especially to countries with expensive healthcare systems, usually demand higher medical limits.

When thinking about what does travel insurance cover, medical protection and evacuation limits deserve the closest attention. Trip cancellation limits should at least match the total prepaid cost of your trip.

Some travelers skip coverage entirely, believing nothing will go wrong. That may be true most of the time. Yet travel disruptions, medical emergencies, and airline mishaps occur regularly. Insurance exists not because problems are guaranteed, but because they are unpredictable.

Final Thoughts

At its core, travel insurance is about preparing for uncertainty. The question isn’t whether your trip will go perfectly, but whether you can absorb the financial impact if it doesn’t. When evaluating what Does travel insurance cover, focus on medical protection, trip cancellation, trip interruption, and emergency medical expenses first. Then consider.